Last Updated: October 23, 2025

Welcome to Eli Sklar Consulting (“we,” “our,” or “us”). These Terms and Conditions (“Terms”) govern your use of our website, www.elisklarloans.com, and any related services offered by Eli Sklar Consulting (collectively, the “Services”).

By accessing or using our website, you agree to these Terms. If you do not agree, please discontinue use immediately.

1. Our Services

Eli Sklar Consulting provides mortgage consulting and brokerage services. We help clients explore, compare, and apply for mortgage and loan products through our network of trusted lending partners.

All loan approvals, terms, and rates are subject to review by the lender and depend on factors such as creditworthiness, income verification, and other eligibility requirements.

2. No Guarantee or Financial Advice

Information provided on our website is for informational purposes only and does not constitute legal, financial, or tax advice.

Loan approvals and rates are not guaranteed and are determined by the lender.

You are encouraged to seek independent financial advice before making any financial decisions.

3. Eligibility

You must be at least 18 years old and a U.S. resident to use our Services. By using our site, you represent that all information you provide is accurate and truthful.

4. User Responsibilities

When submitting information through our forms or communications, you agree to:

Provide accurate, complete, and current information.

Not use the website for any unlawful or fraudulent purpose.

Not impersonate another person or entity.

5. Third-Party Links

Our website may contain links to third-party websites or partner platforms. These links are provided for convenience and do not imply endorsement. We are not responsible for the content, security, or privacy practices of third-party sites.

6. Intellectual Property

All website content—including text, graphics, logos, and layouts—is owned or licensed by Eli Sklar Consulting and protected by applicable copyright and trademark laws. You may not reproduce or distribute any content without prior written consent.

7. Limitation of Liability

Eli Sklar Consulting is not liable for any damages arising from your use or inability to use our Services. We make no warranties or representations, express or implied, regarding the accuracy, completeness, or reliability of the information provided on this site.

8. Indemnification

You agree to indemnify and hold harmless Eli Sklar Consulting, its affiliates, and its representatives from any claims, damages, or expenses resulting from your use of our website or breach of these Terms.

9. Modifications

We reserve the right to update or modify these Terms at any time. Updates will be posted on this page with a revised “Last Updated” date.

10. Governing Law

These Terms are governed by the laws of the State of New York, without regard to its conflict of law principles.

11. Contact Us

If you have questions about these Terms, please contact us at:

📞 +1 (516) 902-8593

🌐 elisklarloans.com

✉️ [email protected]

U.S. Mortgage Market Update — December 2025: Rates Drift Down

U.S. Mortgage Market Update — December 2025

As we move into the final month of 2025, the mortgage market is showing signs of cooling — and some opportunity for homebuyers and refinancers. Below is a snapshot of where things stand, and what to watch for in the weeks ahead.

📉 Rates Have Drifted Down — Maybe an Opportunity

As of early December, the average rate for a 30‑year fixed mortgage in the U.S. has dipped to about 6.19% — 6.23%, according to Freddie Mac and other national surveys.

That’s a modest drop from earlier in 2025, when rates spent much of the year hovering above the 6.7%–7.0% range.

Even 15‑year fixed mortgages are trending downward, with averages around 5.44%–5.51%.

In short: rates have moved off their 2025 highs and are now near their lowest levels in over a year — creating a slightly more favorable rate climate.

🔮 What’s Driving This — And What Could Influence Future Movements

Part of the drop reflects expectations around short‑term interest rate cuts by the Federal Reserve. While the Fed’s moves don’t always translate directly into mortgage‑rate changes, they do influence the broader yield environment that underlies mortgage pricing.

That said, even if the Fed cuts next week, some analysts warn the impact on long-term mortgages may be limited — meaning rates might not tumble dramatically.

Meanwhile, home affordability remains a concern. Even with better rates, high home prices and economic uncertainty (job growth, employment conditions, etc.) continue to drive caution among buyers.

🏡 What This Means for Buyers, Refinancers & Brokers

For buyers: If you’ve been waiting for rates to ease before locking in — now could be a good window. Prices are lower than mid‑year peaks, and 30‑year rates have dropped modestly.

For homeowners looking to refinance: Falling rates and stable conditions could make refinancing more attractive — but timing is still key. With potential Fed moves and market volatility ahead, comparing offers and locking in when you find favorable terms remains wise.

For brokers/ISOs (like those working with Eli Sklar Loans): This environment might revive some demand. Borrowers may now be more open to re‑examining their financing — especially those who sat out earlier rounds of high rates. A good time to engage leads, highlight rate drops, and push preapproval or refinance conversation.

🎯 What to Watch in December & Early 2026

Fed decisions and subsequent market reactions — which could cause swings in long-term mortgage yields.

New economic data (inflation reports, employment) that influences investor sentiment and bond yields.

Home price trends: if prices continue rising, even relatively “low” mortgage rates may not translate into better affordability.

Inventory and supply dynamics: housing supply remains tight in many markets, which could counterbalance interest‑rate improvements and keep home prices elevated.

🧭 Bottom Line

At the moment, mortgage rates have drifted downward — no longer at 2025 highs, but not at rock‑bottom either. For many buyers and homeowners, this may be a “sweet spot”: rates low enough to matter, but before any potential year‑end volatility.

If you’re working with clients (or are a client yourself) and rates make sense — now might be the time to lock something in.

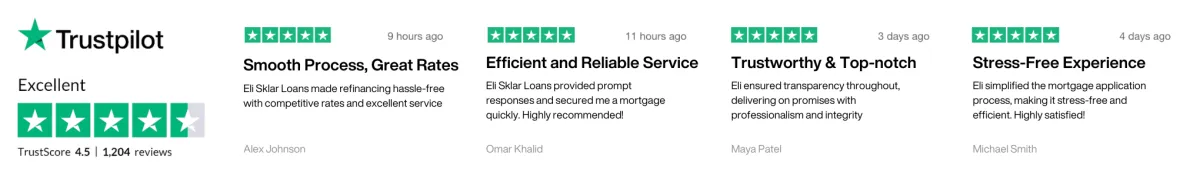

SUCCESS STORIES FROM OUR CLIENTS

I can't thank Eli enough for his assistance in securing a loan for my commercial property. His expertise and attention to detail were remarkable. Eli not only helped me find the right lender but also negotiated favorable terms that fit my financial goals. He made the entire process seamless and stress-free, and I felt confident knowing I had an expert advocating for my best interests. He is a true professional, and I highly recommend his services to anyone seeking a commercial loan.

Mike Erman

Real Estate Agent

Eli is an exceptional loan expert who helped me secure a commercial loan for my business expansion. His deep knowledge of the lending industry and his strong relationships with lenders made the process smooth and efficient. Eli took the time to understand my specific needs and goals, and he went above and beyond to ensure I received the best terms and rates. Thanks to Eli's expertise and dedication, I was able to take my business to the next level. I highly recommend Eli!

Jake Flynn

Real Estate Agent

Working with Eli was a game-changer for me as a real estate investor. His expertise and his ability to identify the right financing options truly impressed me. Eli took the time to understand my investment strategy and found tailored loan solutions that aligned perfectly with my goals. His professionalism, responsiveness, and attention to detail made the entire process stress-free. I am grateful to have had Eli as my trusted partner, and I highly recommend him to anyone!

Jan Brooks

Real Estate Agent

Copyright© Eli Sklar Loans 2025. All Rights Reserved.

+1 (516) 902‑8593